Commercial CAIS (Credit Account Information Sharing) is Experian's shared database of business' credit commitments. It shows whether accounts are active, settled or defaulted and, where relevant, offers a month-on-month indication of the payment performance.

Members must provide a CAIS file every month. Experian validate each file before it is loaded into the Commercial CAIS database, to ensure that reporting is fair and accurate as required by the GDPR. It is essential that each month's CAIS file is timely, accurate and contains updates for all previously reported accounts as well as any new accounts added to the portfolio since the previous month's file. The data provided must accurately report the position of each account at the effective date, as you would advise it to your customers. Members must address, on an ongoing basis, any data quality issues highlighted by Experian and respond promptly to queries, including those raised by data subjects.

Data testing

You must provide test files comprised of your complete production (live) data so that we can verify that they are correctly formatted and are of suitable quality.

These files must contain examples of:

It is recognised that in some cases (e.g. lenders or products that are new-to-market) a lender may not yet have production records for all these scenarios. In these cases, the lender should simulate these scenarios in their systems (via related business processes where necessary) to verify that they can correctly report them when they occur in the future.

Members are expected to have an ongoing data management programme to address any data quality issues that may arise in the course of sharing Commercial CAIS data. This is necessary to ensure that data quality problems are proactively managed and eliminated to avoid customer detriment and maximise the quality and quantity of Commercial CAIS data shared among members.

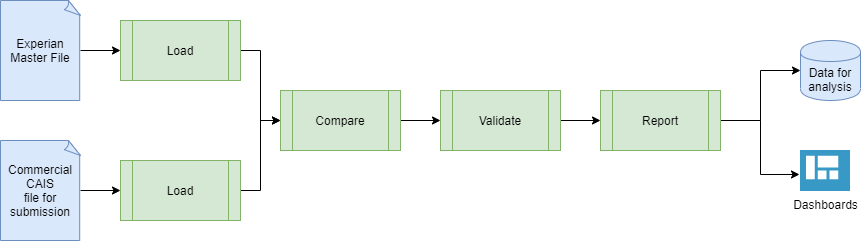

Commercial CAIS validation is the process of loading the Master file for the portfolio held by Experian, and comparing that to the monthly file being submitted.

Validation rules are then run to identify any issues with the monthly submission, which may cause individual records, or even the entire file, to be rejected.

The information is then summarised for reporting, and can be exported to other systems for remediation.

The package described here performs all phases of this process, and can be customised to your needs with the assistance of Experian consulting services.

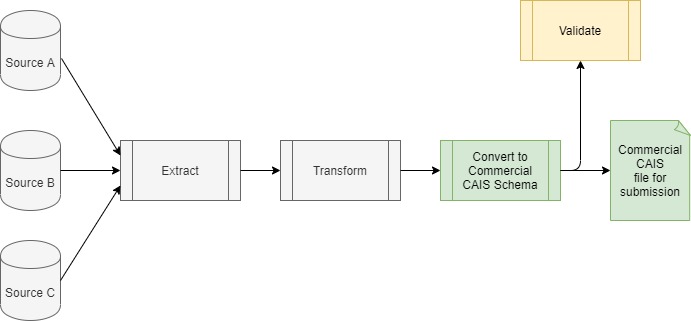

Commercial CAIS on-boarding is the activity of consolidating and aggregating source data as required for reporting to Experian, and then converting into the required format.

The package described here performs the last two phases of this process. Aperture Data Studio, along with assistance from Experian consultants can help transform your data into the required fields, if not done already.