Consumer CAIS (Credit Account Information Sharing) is a dataset submitted to Experian Credit Bureau containing records of consumers' credit commitments whether defaulted, settled or active and, where appropriate, a month on month indication of the payment performance.

Experian CAIS gathers data from and collects over 500 million credit accounts a month making CAIS one of the largest sources of UK consumer credit commitments.

Accurate and timely submission enables Financial Institutions to:

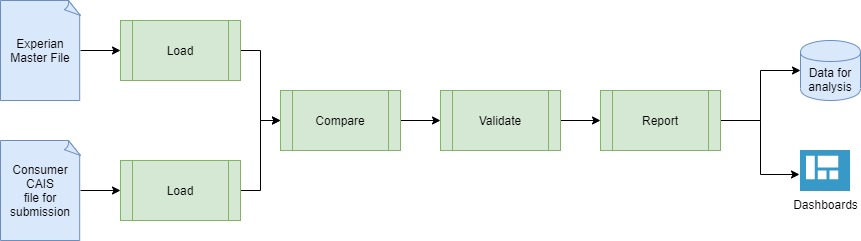

Consumer CAIS validation is the process of loading the Master file for the portfolio held by Experian, and comparing that to the monthly file being submitted.

Validation rules are then run to identify any issues with the monthly submission, which may cause individual records, or even the entire file, to be rejected.

The information is then summarised for reporting, and can be exported to other systems for remediation.

The package described here performs all phases of this process, and can be customised to your needs with the assistance of Experian consulting services.

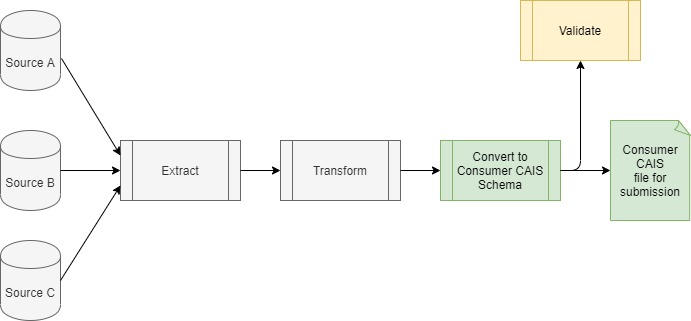

Consumer CAIS on-boarding is the activity of consolidating and aggregating source data as required for reporting to Experian, and then converting into the required format.

The package described here performs the last two phases of this process. Aperture Data Studio, along with assistance from Experian consultants can help transform your data into the required fields, if not done already.